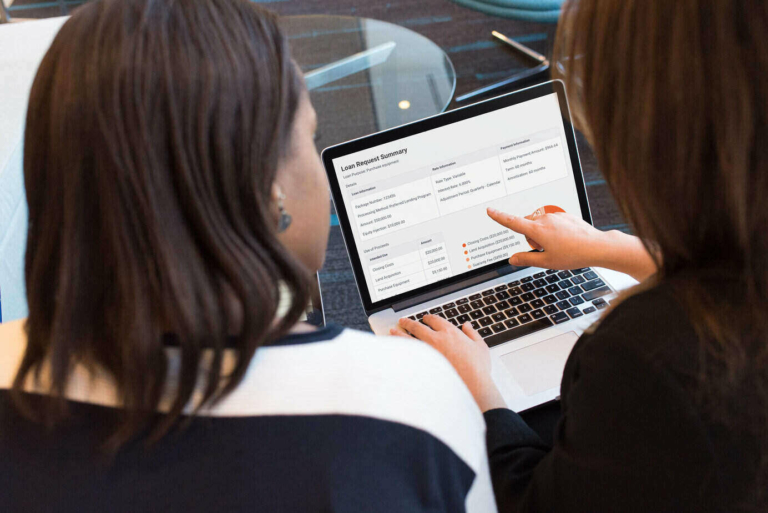

You Won’t Find a Better SBA Lending Platform

At SPARK, we’re obsessed with SBA. We’ve seen its inner workings. We’ve built a product centered around it. We understand the positive impact SBA lending can have on our communities, particularly in challenging times. That’s why we challenge anyone to find a platform better suited to SBA than SP...